UK Government Strategies in the First Half of 2025

Elcern Consulting looked at UK government strategies published during the first half of the year. Our aim was to help organisations be aware of and locate government priorities that may be relevant. We set our findings out in the form of a timeline, and along the way drew some insights we think organisations and even government may find useful.

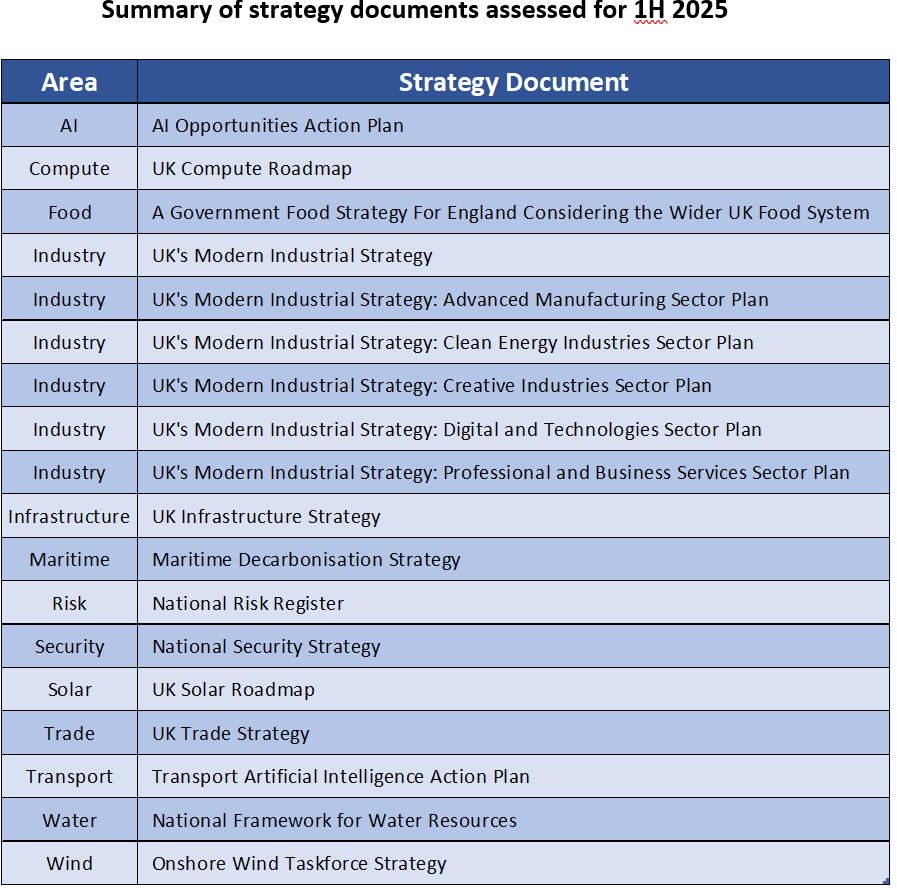

Overall, we found 18 UK government strategis published during the first half of 2025. And we couldn’t confirm that we got all government strategy documents without a roadmap or other landscape to check against.

Without the picture on the box, it’s hard to know which pieces of the jigsaw would be missed, and what’s planned for the rest of this year. Clearly 18 strategies within six months is quite a run rate, which we hope won’t be maintained through to year end, solely to limit the complexity of the resulting landscape.

Looking at the first half of the year in more detail, we found that June was by far the key month, with its 12 strategies. But along the way, here was the trend and a summary of what we found.

In June 2025, the government published two further strategies, one on industry and one on infrastructure:

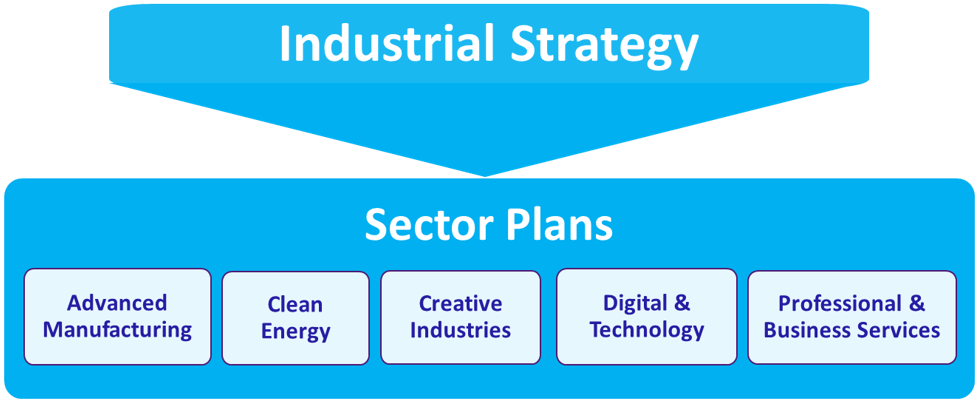

Within the June Industrial Strategy the government identified eight sectors of the economy as best positioned to drive inclusive, sustainable, and resilient growth. Those are seen as holding the most potential to create well-paid jobs across the UK, leverage the net zero transition, and giving global influence.

To date, five Sector Plans have been created (for Advanced Manufacturing, Clean Energy Industries, Creative Industries, Digital and Technologies and Professional and Business Services – see insert).

A further three Sector Plans (for Defence, Life Sciences and Financial Services) are expected later this year.

In June the government also issued the Industrial Strategy Zones Action Plan. The Plan set out how it will deliver and support 22 Industrial Strategy Zones (IAZs) in major cities and regions across the UK. Like its AI Growth Zones, the IAZs will benefit from novel planning approaches and central support that assist Local Planning Authorities deal with the resulting large-scale planning applications.

June also saw government publication of four further strategy documents, tackling positions on national security, solar, trade and water (see insert below).

2025 actually kicked off with the government’s publication of two key strategy documents in January: The AI Opportunities Action Plan and its latest UK National Risk Register:

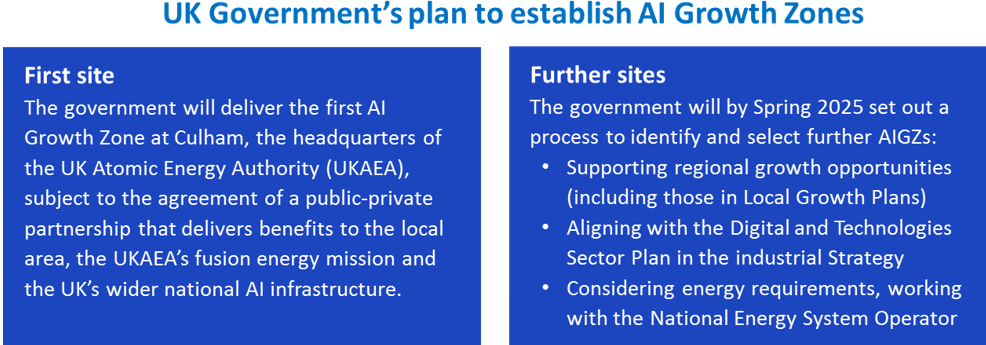

The AI Opportunities Action Plan set out 50 recommendations to proactively shape future AI to drive UK economic growth, and so avoid the UK becoming a passive consumer of other country’s AI.

The Plan’s 4th recommendation, to “Establish AI Growth Zones (AIGZs)”, could in our view be one of the most significant economic developments in the UK. Alongside the 10 or more UK hyperscale data centre investments announced mainly by US operators, these planned AIGZs may bring one of the greatest concentrations of data centres in the world (see insert of extracts of the UK Government’s AI Plan).

In our view, the AI Opportunities Action Plan recommendation’s 4th recommendation to establish AI Growth Zones around the country could result in one of the most fundamental changes to the UK economy and landscape. Here organisations can align their bids to build AI Growth Zones with the government’s Industrial and Infrastructure Strategies, and the Industrial Strategy’s Sector Plans.

The National Risk Register identified and assessed risks of major emergencies that might impact the UK, looking ahead two years. Those risks included physical and cyber-attacks, natural and weather disasters, failures in electricity or water supply, major diseases in humans or plants, and many others.

Everyone is expected to play their part in building resilience against emergencies. And, in our view all risk and resilience professionals may benefit from periodically validating their own organisation’s risk assessment against the latest register.

Whilst not explicit, these risks could impact the future AI opportunities, and indeed other 2025 strategies. Electricity outage for example might disastrously impact the viability of AIGZs (see insert on risk titles from the NRR 2025).

So we regard the NRR 2025 as a key risk resource for any strategy. That drove us to include NRR 2025 within this current viewpoint.

The Transport sector published its own AI Action Plan during June (see insert). And in March the government’s Maritime Decarbonisation Strategy.

Rounding out the year to date, July saw three further strategies joined the count: compute (roadmap), onshore wind and food. Onshore wind is particularly notable as freeing up the approval of such projects was an early move by the new UK government made to accelerate clean power supplies to industries and homes.

So hopefully you see there’s a lot for organisations to digest in the landscape we have shown above and summarised in the table below.

Organisations aligning with the above government strategies through awareness of content, actions, opportunities may be able to achieve competitive or reputational advantage while simultaneously contributing to UK economic growth.

However, its worth also noting the complexity of this landscape.

That complexity arises initially through terms of the sheer amount of government documentation, its variety of styles and content. Then the lack of some form of landscape setting out the intended strategy coverage is in our opinion a major impediment. That gap leads to a risk or even issue of overlaps between the individual strategies.

We also have reservations about the adequacy and consistency of government monitoring of the actions and their outcomes.

However in summary a lot of work has been delivered by government during the first part of this year in the strategy space alone. And, we know there’s lots more to come, both in terms of further strategy documents and monitoring the status of actions within such documents.

Elcern Consulting is a boutique management consultancy that supports organisations with strategy, business planning, risk management, compliance, business process mapping and training. Within our public sector practice, we maintain a database of 56 UK government strategy documents issued from 2020 to date.

We look forwards to helping organisations get to grips with details of relevant strategies.

Do reach out with comments, questions or requests for help in this fascinating field.

Disclaimer: It is important to remember that our list does not attempt a comprehensive coverage of all pertinent strategies, frameworks or plans. Readers should always conduct their own research and draw their own conclusions from the original source documents.